Market Matters – Credit Jitters, Calm Heads

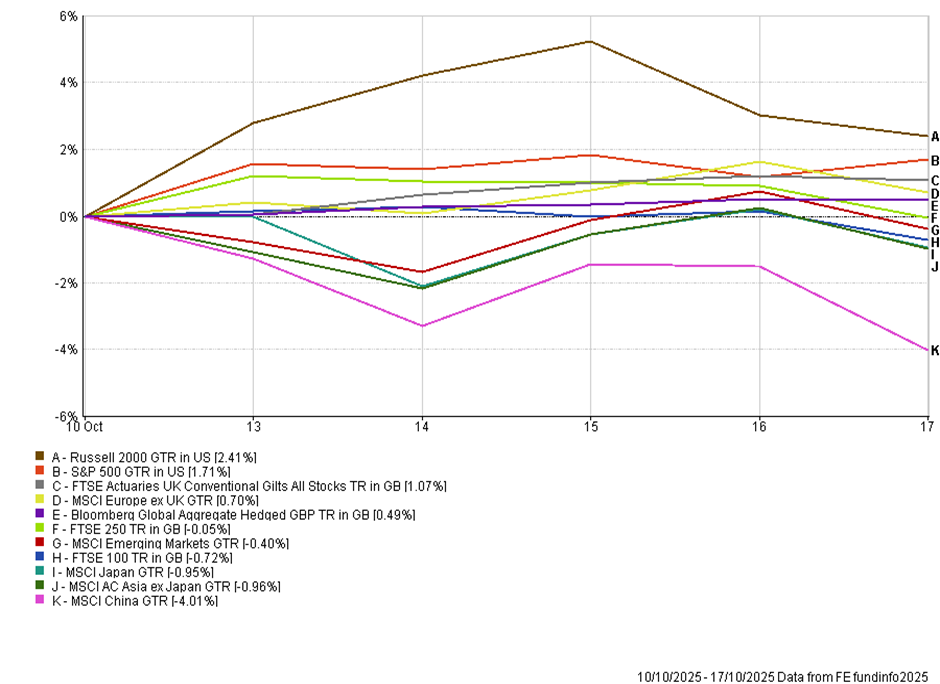

Jamie Dimon’s ‘cockroach’ metaphor might have stolen the headlines this week, a reminder that the odd default can sometimes hint at broader credit fragility, but so far the infestation looks contained. Markets had a nervy few days as regional bank names stumbled and private credit came under scrutiny, yet the reaction was more consolidation than crisis. The VIX spiked and risk appetite cooled early in the week, but Friday’s recovery steadied the ship. With Fed cuts still expected before year-end and earnings broadly reassuring, investors appear to be renting a bit of pessimism rather than abandoning optimism outright.

Despite the rise in nervousness, the week ended on a surprisingly positive note. US equities finished higher, supported by a strong start to the third-quarter earnings season, particularly among the large banks where investment-banking revenues have rebounded. Fixed income markets also firmed, with US Treasuries and gilts both advancing as yields edged lower. The 10-year US Treasury yield briefly slipped below 4%, while UK gilts rallied in anticipation of further Bank of England easing later this year. The combination of steady earnings and softer yields helped restore confidence after what began as a jittery week.

Trump & China

The shift in tone from Washington also helped calm nerves. Just a week after threatening 100% tariffs and hinting he might cancel his meeting with President Xi, Donald Trump softened his stance, calling the return to punitive trade measures ‘not sustainable’. Treasury Secretary Scott Bessent confirmed he will meet China’s Vice Premier He Lifeng in Malaysia next week to prepare for the two presidents’ face-to-face later this month. Their discussions on Friday were described as ‘frank and detailed,’ but notably constructive, the first clear sign in weeks that both sides want to de-escalate. The diplomatic choreography was enough to convince markets that the tariff conflict remains a risk, but crucially not an inevitability.

For investors, that shift matters. The earlier flare-up in rhetoric had been weighing on sentiment through September and early October, fanning fears of renewed inflationary pressure via supply-chain disruption. But as both sides step back from the brink, attention has returned to the underlying fundamentals: earnings, rates, and policy direction. With tariffs now viewed as a bargaining chip rather than an imminent threat, the prospect of another damaging trade shock to global growth looks to have receded, at least for now.

Policy Patience and Powell’s Balancing Act

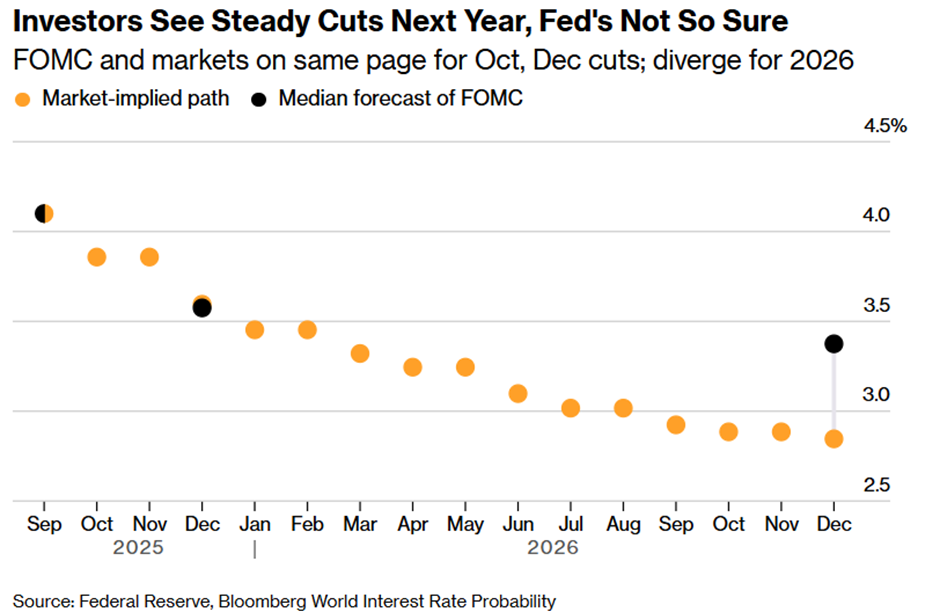

If the week’s headlines on trade and credit offered short-term reassurance, it was the Federal Reserve that provided the real anchor for sentiment. Chair Jerome Powell signalled that another rate cut later this month is all but certain, citing a weakening jobs market that now outweighs lingering inflation fears. His warning that ‘further declines in job openings might very well show up in unemployment’ was widely read as confirmation that the Fed will move again on 29 October.

Markets, for once, are aligned with the central bank for this year, although they may go their separate ways next year. Futures are pricing two further cuts this year in October and December, though Powell himself stopped short of validating that trajectory. The message from policymakers remains nuanced: inflation is easing but still above target, growth has cooled but not collapsed, and the ongoing government shutdown has left the data flow patchy at best. Within that fog, the Fed’s emphasis has shifted from ‘higher for longer’ to ‘steady but responsive.’

That stance should continue to underpin equity markets. With the 10-year Treasury yield dipping below 4% and rate expectations moving in a dovish direction, valuation pressure has eased just as earnings season begins to deliver more positive surprises. It also reinforces the idea that policy is turning from a headwind to a mild tailwind, one very big reason why the S&P 500 remains near record highs despite bouts of anxiety elsewhere.

Still, the debate inside the Fed is far from settled. Governors Waller and Bowman have maintained their focus on employment risks, while newer voices such as Stephen Miran have pushed for faster and deeper easing. On the other side, regional presidents, including Cleveland’s Beth Hammack and Dallas’s Lorie Logan, have urged caution, highlighting persistent upside risks to inflation, particularly if tariffs return to the agenda. As Powell’s term approaches its end next May, the political dimension of Fed policy is also coming into sharper view.

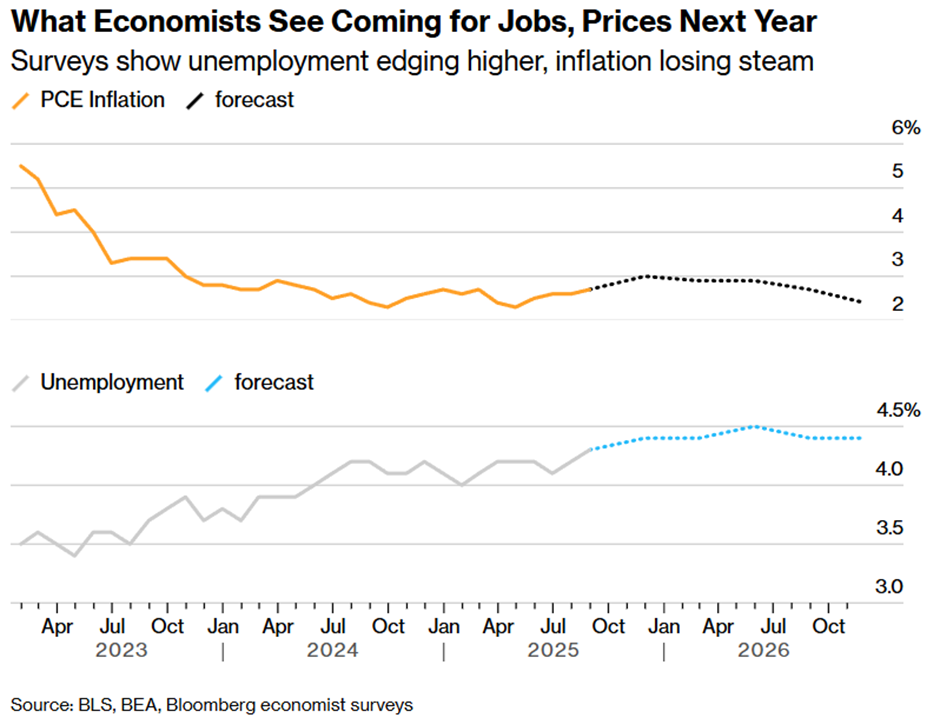

For now, though, the combination of a patient Fed, softer yields, and resilient earnings growth continues to provide a sturdy floor for risk assets. Monetary policy may not be driving the rally, but it’s no longer standing in its way. That picture could be tested next week with the release of September CPI data, one of the few major datasets still being produced by the Bureau of Labour Statistics despite the government shutdown. Economists expect headline inflation to edge lower as energy prices ease, while core inflation is forecast to remain steady near 3.1%. Any surprise to the upside could reignite debate within the Fed about how much room it truly has to cut, particularly as service prices and wage pressures remain sticky.

Still, the broader trend is moving in the right direction. Inflation has moderated from its summer highs, real wages are improving, and the labour market, though softer, continues to function without signs of broad stress. That mix allows Powell to proceed cautiously, still supporting the soft-landing narrative and keeping investors confident that the next phase of the cycle will be characterised by lower rates, steady growth and continued opportunity for equities to grind higher rather than give ground.

Earnings Take Centre Stage

While policy dominates the headlines, markets ultimately come down to earnings. As Benjamin Graham famously said, ‘in the short term, the market is a voting machine, but in the long term, it’s a weighing machine,’ and what it weighs most carefully is corporate profitability.

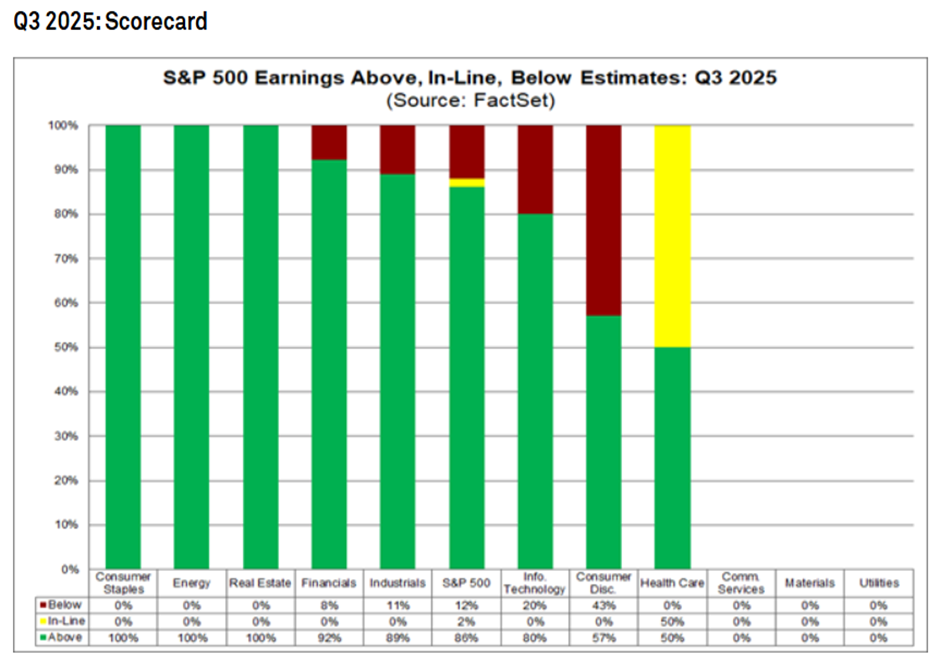

At this early stage, the US Q3 reporting season is off to a broadly encouraging start. According to FactSet, 12% of S&P 500 companies have now reported, with 86% beating earnings expectations, well above both the five and ten-year averages. The magnitude of those beats has been slightly smaller than usual, but the direction is positive: the blended earnings growth rate has risen to 8.5%, up from 7.9% at the end of September, marking a ninth consecutive quarter of year-on-year profit growth.

Revenues are also running ahead of forecasts, up 6.6% year-on-year, led by strong showings in Information Technology, Financials, and Utilities. The breadth is striking; ten of eleven sectors are now expected to post positive revenue growth, with only Energy lagging as prices normalise from last year’s peaks. Importantly, the revenue surprise rate (84%) is the highest in years, underlining that companies are not just beating on efficiency, but on genuine top-line demand.

The financial sector has been the standout early contributor, with positive surprises in both earnings and revenues. That’s been enough to steady nerves after last week’s regional banking wobble, reinforcing the sense that the US consumer and corporate borrower remain in good shape. Tech and healthcare have also delivered robust results, while margins more broadly appear to be holding up better than feared, suggesting that tariff pressures and higher wages have yet to bite materially.

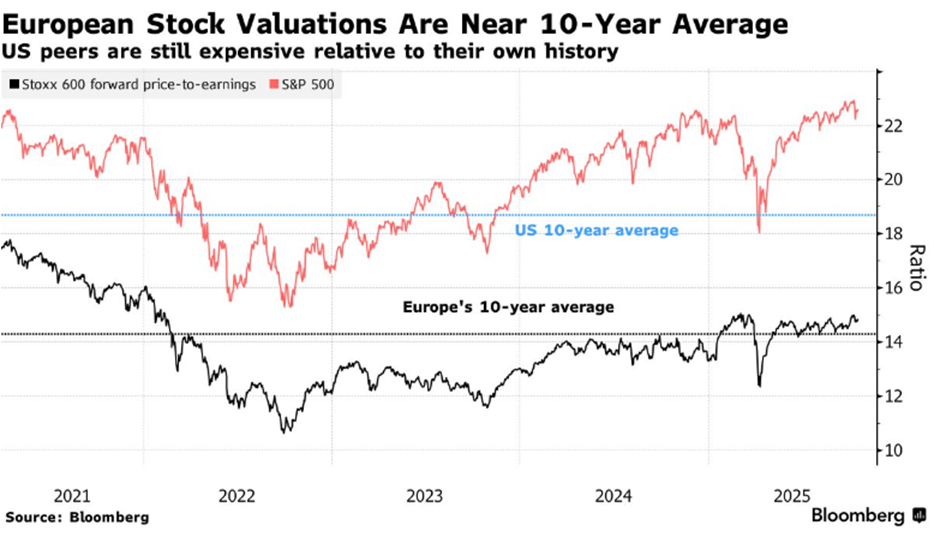

If the current pattern holds, this will be another quarter in which earnings, rather than liquidity, underpin the market’s gains. That’s a healthier dynamic. With the S&P 500’s forward P/E at 22.4, valuations remain full but not excessive, particularly if earnings continue to compound at double-digit rates into 2026. One thing to consider here when making historical comparisons and leaping to the inevitable conclusion that the PE looks high is the constituents of the S&P 500. The index is now much more tech-heavy and the expected earnings growth much higher than it has ever been before, which does argue for a justification of the higher multiple, although I am wary of saying ‘it’s different this time’.

United Kingdom – Calming the Gilt Gods

There was some rare good news for the Chancellor last week as gilt yields fell sharply, driven by a mix of haven flows, dovish BoE commentary and a deliberate effort by the Treasury to reset the UK’s credibility with bond markets. Ten-year yields slipped toward 4.45%, their lowest in three months, easing pressure on the fiscal arithmetic ahead of November’s Budget. Officials close to Rachel Reeves have been explicit that stabilising the gilt market is now a key objective; the lower the borrowing cost, the more room she has to shape political choices without triggering another credibility crisis.

The Reeves strategy appears two-pronged: calm the market first, consolidate later. That’s bought time, but not forgiveness. Investors will judge the Budget not just by how much is saved or raised, but by the composition of that consolidation. The Institute for Fiscal Studies has made the point plainly that fiscal credibility depends as much on the quality of policy as on the quantity of tightening. The market wants evidence that the UK can break out of the post-Truss doom loop and run a coherent medium-term plan.

Here lies the political dilemma. Spending cuts look politically impossible, given resistance from Reeves’s own MPs. That leaves tax rises as the only serious lever. The IFS notes that even a modest rise in the basic rate of income tax would ‘demonstrate a willingness to spend significant political capital to support fiscal sustainability.’ Economically, it’s sound but unpopular – broad-based, simple, and minimally distortive. Politically, it’s toxic. Any move on income tax, VAT or National Insurance would breach Labour’s core manifesto pledge, yet without it the numbers may not add up.

Hence the sense of stasis: the pre-Budget kite-flying and circling for ideas is itself weighing on activity, as businesses and households wait to see how far Reeves will go. The likeliest outcome may be a carefully justified manifesto breach presented as a necessary act of fiscal realism rather than betrayal. It could be the best chance to reassure markets that the UK has regained its grip, while keeping Reeves in post long enough to prove it.

Europe — steadier tone and signs of quiet improvement

It was a steadier week across European markets, with bond yields easing, political risks calming, and the ECB sending broadly reassuring signals. Nothing spectacular, but after a long spell of policy uncertainty and headline noise, the region finally feels a little more settled.

The ECB’s message was clear and coordinated: policy is in ‘a good place.’ Christine Lagarde repeated that phrase several times in Washington, backed by most of her colleagues. Chief Economist Philip Lane emphasised that decisions will be taken ‘meeting by meeting’ and remain fully data-dependent. Within the council, familiar divisions persist. France is leaning toward the next move being a cut, Germany is still concerned about inflation, but the consensus is that the current stance is appropriate. Markets took comfort in that stability, with core bond yields drifting lower and volatility easing.

In France, short-term stability helped sentiment. Prime Minister Lecornu’s suspension of pension reforms reduced the immediate risk of a government collapse and allowed OAT yields to tighten versus Bunds. Investors welcomed the pause, even if the fiscal picture remains challenging and the upcoming budget vote and credit-rating reviews will keep pressure on policymakers.

European equities continue to take their cues from the US, but there was a modest improvement in tone. The Stoxx 600 edged higher as investors focused on falling yields, resilient earnings, and the possibility of calmer US-China trade dynamics. Analysts still see limited upside into year-end, reflecting Europe’s slower growth and smaller exposure to the global tech cycle, but seasonal factors are supportive and positioning is light. Valuations have caught up to their long-term averages, but remain cheap relative to the US.

Overall, the region enters the final stretch of the year on a firmer footing. The ECB’s steady hand, cooling political risks, and lower yields provide a measure of stability. Europe remains heavily influenced by events in the US, but for now, the environment looks more balanced and less fragile than it has for much of the year.

China and Asia — signs of recovery, but trade risks linger

China enters the final quarter of the year in a slightly stronger position, though still walking a fine line between recovery and renewed strain. The latest data show improving domestic demand as imports have picked up, luxury sales are rebounding, and companies like LVMH highlighted stronger Chinese consumer activity in their quarterly results. That’s a positive sign that Beijing’s targeted stimulus efforts are filtering through to spending and sentiment, at least modestly.

At the same time, export growth remains subdued and private-sector credit demand is still weak, underlining that China’s rebound is uneven. The economy continues to depend heavily on state-directed investment and selective stimulus, and policymakers have avoided large-scale easing so far. For markets, the question is whether this patchy improvement can hold if global trade tensions re-escalate. Those tensions remain a live risk. Last week’s market wobble followed President Trump’s announcement of an additional 100% tariff on Chinese goods, a move framed as retaliation for Beijing’s export controls on rare-earth materials. The timing is politically charged, and both sides are clearly positioning ahead of the APEC summit in South Korea at the end of the month, where Trump and President Xi are expected to meet face-to-face. Despite the rhetoric, both sides have a strong incentive to stabilise relations: Washington needs to contain inflation pressures, and Beijing can ill afford another hit to confidence or trade flows.

Across the wider region, markets have been steadier. Japan continues to benefit from tariff exemptions and solid export volumes, while Korea and Taiwan have seen support from strong semiconductor and tech demand. Asia remains tethered to U.S. policy and global growth trends, but with Chinese data improving and the prospect of a U.S.–China diplomatic reset later this month, sentiment has at least stopped deteriorating. The coming weeks and the tone from APEC will be crucial in confirming whether that tentative optimism can last.

Looking Ahead – Cautious, but Not Hopeless

It’s fair to say that the mood in markets has turned more cautious. The easy optimism of late summer has given way to something more attentive, a sense that while fundamentals remain supportive, sentiment is fragile and investors are quicker to take profits. The volatility spike this week reflects that shift. Between the flare-up in trade tensions, worries about regional banks, and ongoing uncertainty over the US shutdown, there’s no shortage of reasons to stay alert.

Yet, beneath the noise, the market still has several sturdy supports. Corporate earnings are coming through better than feared, with the large banks leading the way and early results from other sectors broadly encouraging. The Federal Reserve remains on course to cut rates again later this month, and expectations for further easing into 2026 are well-anchored. Inflation looks to be moderating, oil prices have softened, and consumers, particularly in the US, are still spending.

Even the political backdrop offers some potential tailwinds. The upcoming OBBA tax relief package, due early next year, should boost disposable income and corporate cash flow, providing a fiscal offset to tighter credit conditions. And while there have been a few ‘cockroaches’ in the system, they look more like isolated incidents than signs of systemic stress. Larger banks remain well-capitalised, credit spreads are contained, and policymakers appear ready to step in if needed.

This Week…

- US CPI (24 Oct): Inflation will remain centre-stage. Headline and core prints could shake markets if upside surprises hit, especially given the partial data pause from the government shutdown.

- Earnings ramp: The Q3 season picks up further, with 90+ S&P 500 companies reporting, including five Dow 30 components. Tech and industrials are among the next wave.

- Global risk events: Watch the start of the APEC summit in South Korea (end of October) and ongoing US–China trade diplomacy. Also: Japan’s industrial production data and the UK’s upcoming Budget loom for global asset flows.

- Fixed income clues: With yields near key levels, any surprise in inflation, geopolitical risk or central-bank signalling could trigger sharp moves in duration and curves.

So yes, volatility has returned, and the path ahead is unlikely to be smooth. But with earnings still rising, rates heading lower, and fiscal support on the horizon, it feels more like a market in digestion than one on the verge of decline.