Market Matters – Fatigue, Fog, and Fed Caution

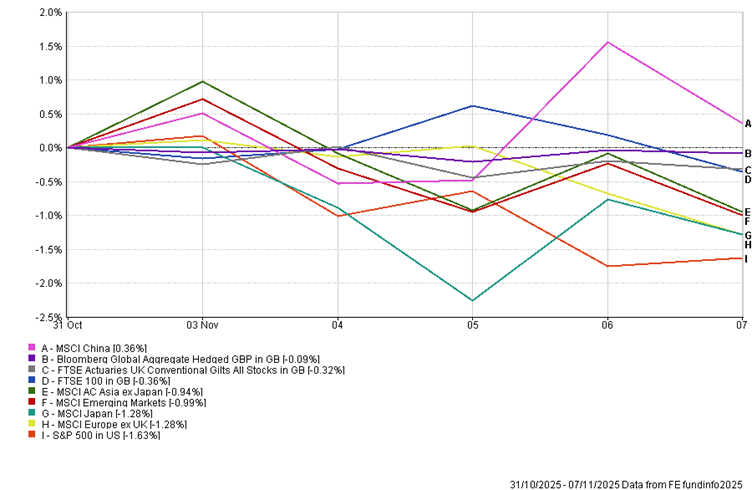

After six months of relentless gains, global markets finally took a breath. The week felt less like a sell-off and more like fatigue, investors pausing for breath rather than bracing for impact. The Nasdaq logged its worst week since April, with the S&P 500 slipping 1.5%, and even Europe and Japan eased back by 1–1.3%. Only China managed a modest gain, hinting at just how selective momentum has become.

The tone in markets has shifted from euphoria to evaluation. The US government shutdown is weighing on sentiment, reviving memories of previous fiscal standoffs and feeding uncertainty over the economic data flow. The result has been a subtle but significant change in tone, although I don’t want to over-dramatise this as I would say risk appetite is cooling, not collapsing.

United States — Shutdown, Soft Data, and Market Fatigue

The longest government shutdown in US history has left markets and policymakers operating in near-darkness. With most federal agencies shuttered, key economic releases, including non-farm payrolls, have been delayed, forcing investors to rely on private surveys and sentiment data to gauge the state of the economy. The political standoff has become as much a test of patience as a policy issue, though reports late in the week suggested lawmakers were inching closer to a deal. That prospect was enough to spark a late rebound, helping Wall Street trim losses after a bruising few sessions.

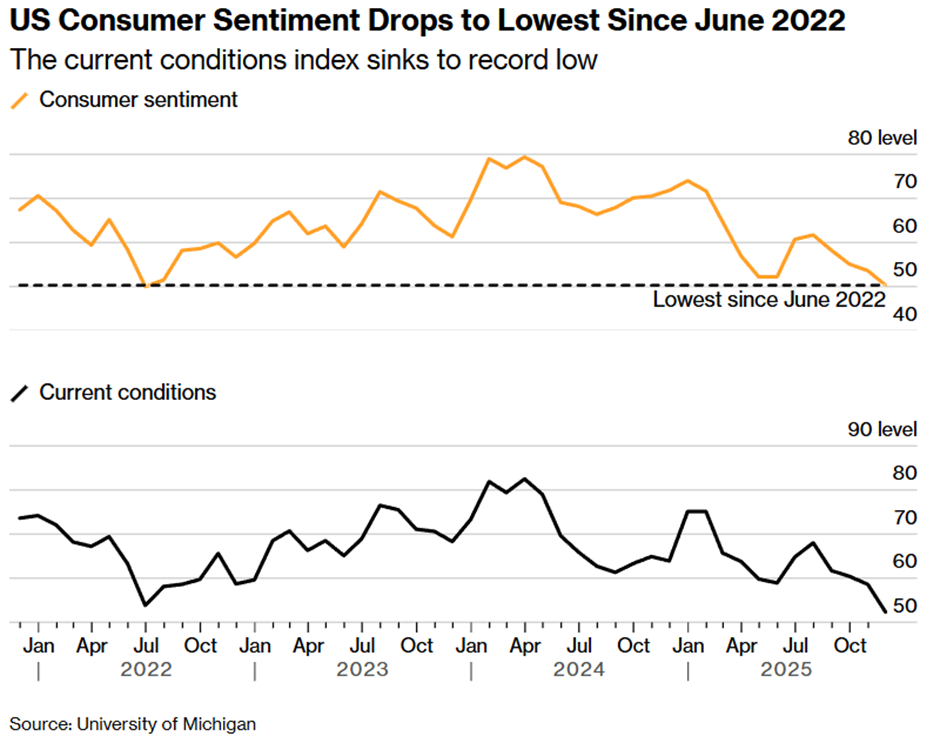

Even so, the damage to confidence is real. The University of Michigan’s preliminary November survey showed consumer sentiment tumbling to 50.3, its second-lowest level since the late 1970s, while the measure of current conditions hit a record low.

The decline in sentiment was broad-based, affecting all age groups, income levels, and political affiliations, and underscored the pressure on lower-income households facing high borrowing costs and persistent price increases. Fears about job losses are rising too, as 71% of respondents now expect unemployment to increase over the next year, more than double last autumn’s share.

The Challenger job-cuts report added to the picture, showing layoffs up over 15% month-on-month, led by technology, finance, and consumer sectors. The ADP private-sector payroll report confirmed only 42,000 new jobs in October, which was the weakest gain in three months. Together, they suggest that the labour market is losing momentum even before the shutdown’s full impact is felt.

All of this leans against the tone struck by Chair Powell at the last FOMC, when he cautioned that rate cuts were ‘far from a foregone conclusion.’ Markets are now leaning the other way. The combination of a protracted shutdown, fading consumer confidence and softer job data tilts the odds back toward a December cut, especially with credit conditions tightening through the repo market and liquidity still constrained.

For equity investors, the pullback looks more like AI fatigue than full-blown fear. The Nasdaq 100 endured its worst week since April as the frothiest parts of the ‘AI momentum trade’ came under pressure, with Palantir one of the hardest hit. After six straight months of gains, profit-taking feels overdue rather than ominous. As one strategist put it, ‘this looks like a purge of excess, not a crack in the foundation.’

The Fed’s challenge is to read through the fog: inflation progress is uneven, growth is cooling, and the data blackout has complicated the picture. However, unless the shutdown is resolved quickly, the softening tone across sentiment, jobs, and markets is likely to push the Fed toward a more accommodative stance, not because it wants to, but because the economy is quietly demanding it.

US Politics: Trump novelty fades, and momentum potentially shifts…

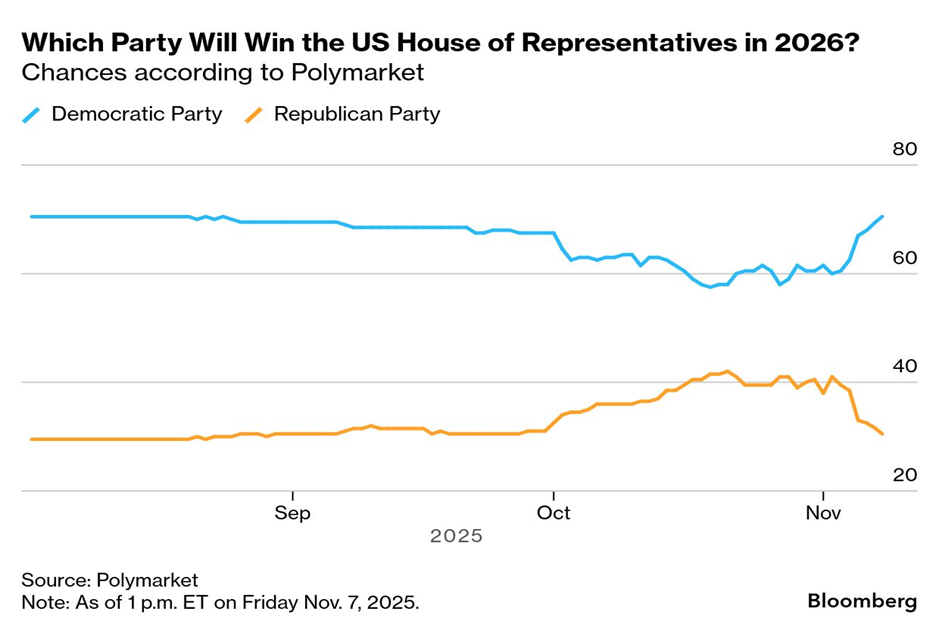

It was a surprisingly strong week for the Democrats in the US off-year elections. They swept races in Virginia, New Jersey, and New York City, while California voters backed a redistricting reform designed to blunt gerrymandering in Republican-controlled states like Texas. The results suggest a subtle shift in political momentum, the novelty of Trump’s dominance may be wearing thin, and the Democrats appear more organised and focused heading into next year.

In New York, Zohran Mamdani’s upset win captured attention as a fresh, grassroots campaign built around affordability and inclusion, energising younger and first-time voters. Elsewhere, Democrats held key governorships and flipped local legislatures once thought out of reach, aided by cost-of-living messaging that resonated across suburban districts.

Markets barely flinched, but political betting markets did. On Polymarket, Democrats’ chances of taking the House of Representatives in 2026 rose to 71%, up more than ten points in a week. The Senate remains a tougher contest, with the probability of a Democratic win rising modestly to around 35%, reflecting the challenging electoral map.

For investors, the implications are less about near-term policy and more about tone. A stronger Democratic showing would likely moderate the fiscal and trade direction of the current administration, while reducing the volatility associated with one-party dominance. Either way, the 2026 midterms are shaping up as a genuine contest rather than a coronation, but it is too early to tell if investors would take more comfort from gridlock or a full Republican mandate.

Corporate America — quietly stronger than it looks

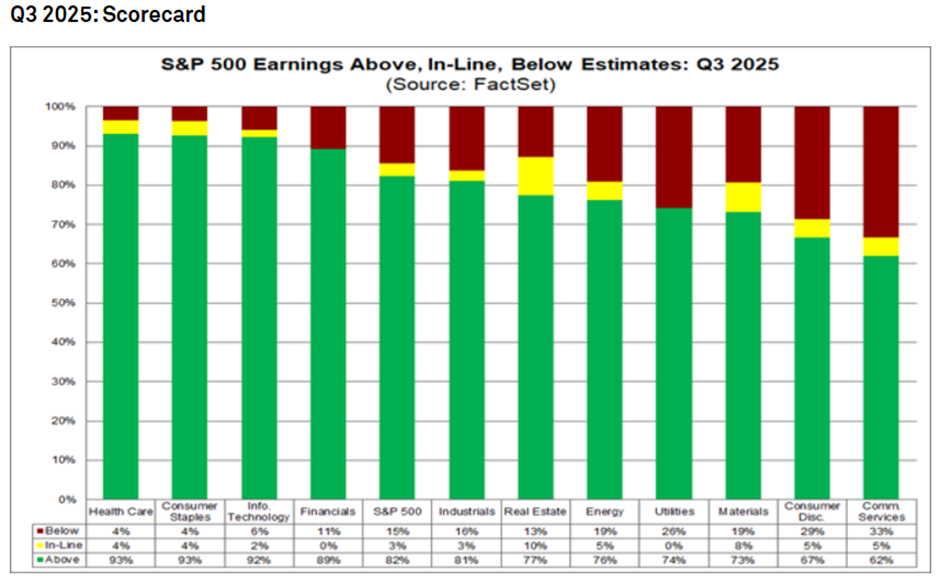

For all the talk of fatigue, corporate America is finishing the third-quarter earnings season on a solid note. With more than 90% of S&P 500 companies now reported, results have been consistently better than expected. Around 82% of companies beat earnings forecasts, the highest proportion since 2021, and revenue surprises have been broad-based across sectors from tech and industrials to financials and healthcare. The blended earnings growth rate now sits above 13%, marking the fourth straight quarter of double-digit expansion.

This result is significant because it underscores that the foundations of US profitability remain robust, even as headline valuations stretch. Margins and balance sheets across the index are far healthier than in previous cycles; today’s S&P 500 is dominated by high-return, cash-generative businesses with structurally higher profitability than its 1990s or 2000s incarnations. That shift toward technology, healthcare, and asset-light service sectors is why earnings have held up even as policy tightened, and I would argue that it is a primary reason why traditional valuation metrics may not be as relevant today as they were five years ago.

Looking ahead, earnings momentum could persist into 2026. The OBBA fiscal package scheduled for rollout next year will inject fresh public-sector demand just as private investment is recovering. More quietly, recent changes to corporate depreciation rules, which allow for faster tax relief on capital expenditures, should support business investment and cash flow in the year ahead. Those provisions, combined with the prospect of a Fed rate cut in December, could help extend the cycle and offset some of the market’s valuation anxiety. Put simply, beneath the noise of shutdown headlines and AI fatigue, the corporate picture looks sturdier than the sentiment suggests. The market may be tired, but the engine underneath is still running smoothly!

United Kingdom — A Dovish Hold

The Bank of England took centre stage this week, delivering what most will read as a dovish hold. The MPC voted 5–4 to keep Bank Rate at 4%, but the narrow split and softer language laid clear groundwork for a December cut. Governor Andrew Bailey again cast the decisive vote, this time for patience rather than action, though, as his accompanying statement leaned closer to the doves than at any point in this cycle.

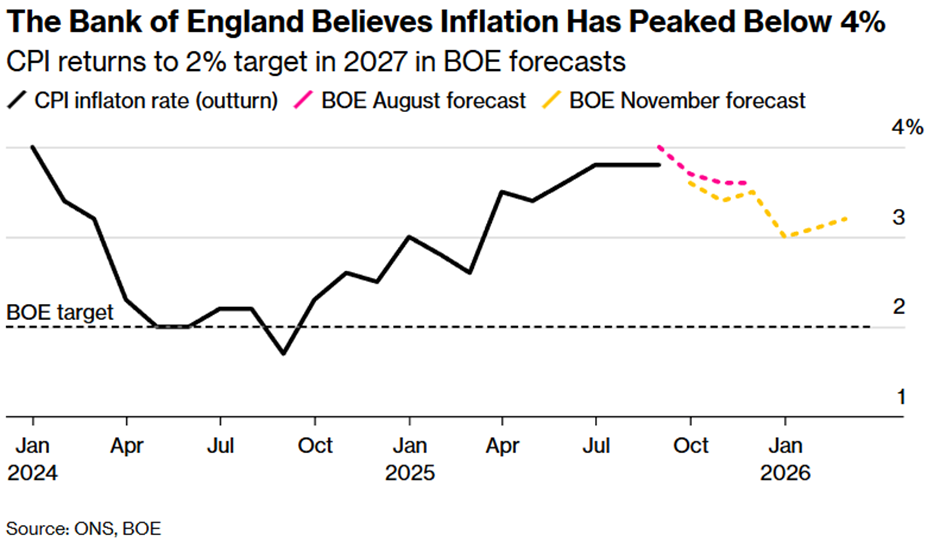

The Bank described September’s 3.8% inflation rate as ‘likely to be the peak’ and quietly removed the word careful from its forward guidance on future cuts. Bailey said the risks to inflation had ‘moved down to become more balanced.’ At the same time, the Monetary Policy Report noted that the risk of inflation persistence has become less pronounced and that the risk to medium-term inflation from weaker demand is now more apparent.

Markets read the shift correctly. Sterling slipped and gilt yields eased, with the two-year yield falling to 3.77%, as traders brought forward expectations for monetary easing. Futures now price just over 50 basis points of cuts by mid-2026, up from 47 basis points before the decision.

This ‘hold’ was a break from the BoE’s quarterly rhythm of easing since mid-2024, but it was more about timing than trajectory. A December move remains firmly on the table, and by then the Bank will have seen the Labour government’s Autumn Budget, as well as two more inflation and jobs prints. Deputy Governor Sarah Breeden joined the doves for the first time, arguing that upside risks to inflation have diminished while downside risks to demand have become more prominent. That marks a subtle but telling shift: for the first time since 2023, the Bank’s internal balance of risk has tilted toward growth.

For now, the BoE’s forecast predicts inflation will fall to 3.1% in early 2026 and reach the 2% target by mid-2027, with unemployment peaking at around 5%. The modest upward revision to this year’s growth forecast (to 1.5%) suggests the economy may yet avoid recession, helped by easing energy costs and a still-resilient services sector. But with fiscal tightening on the horizon and household finances stretched, the Bank’s bias is now unmistakably dovish.

Europe — steadying, but still fragile

Europe offered a flicker of stability last week, though not quite enough to lift the mood. The Eurozone manufacturing PMI held at 50.0, a notch above September’s 49.8, hinting that the industrial downturn may be bottoming. Germany’s reading improved slightly, while Spain and Italy continued to outperform thanks to stronger services demand and tourism. France, however, remained weak, weighed down by softer domestic orders and confidence.

Markets were less forgiving. The Stoxx 600 slipped through the week and ended lower, its worst stretch since August, reflecting a mix of earnings fatigue and global risk aversion rather than any fresh local shock. Export demand across the bloc remains soft, and manufacturing employment continues to contract. While the data suggest stabilisation, they fall well short of recovery.

For now, the region feels like it’s levelling off at low altitude. The ECB, still convinced inflation is easing, signalled no urgency to move either way, keeping its message simple: policy is in a good place and the next move will depend more on growth than on prices.

China — exports slip, resilience tested

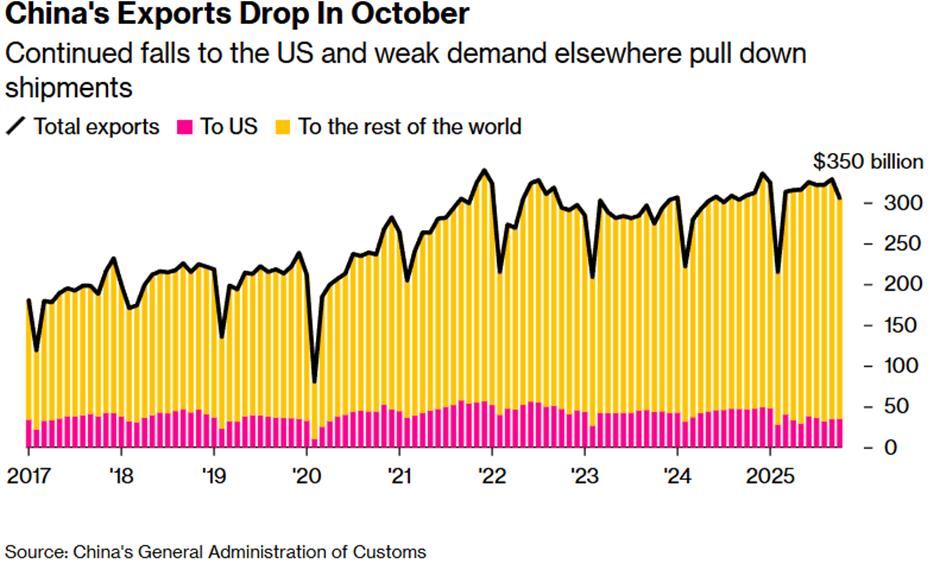

China’s latest trade data delivered a reality check. Exports fell 1.1% year-over-year in October, marking the first decline in eight months, as shipments to the US decreased by more than 25%. The drop surprised almost every forecaster and underscored the fading of the post-COVID export boom. Shipments to other markets, notably Asia and parts of Europe, rose modestly but not nearly enough to offset the weakness in the US.

The figures arrive at a delicate moment. Growth is already slowing under the weight of a prolonged property downturn, soft domestic consumption, and muted private investment. Barclays economists described it as a potential triple whammy for China’s economy, particularly if global demand continues to weaken into the year-end. Activity at Shanghai Port, a reliable bellwether for trade momentum, fell to its lowest level since April, confirming that the soft patch is broad-based.

Still, there are some stabilising forces. The late-October Xi–Trump trade deal, which reduces US tariffs on Chinese goods by 10% starting this week, could provide a short-term boost to exporters’ margins and sentiment. Beijing’s fiscal stance also remains supportive, with local government stimulus and modest credit easing aimed at maintaining the recovery.

More structurally, China’s export profile is evolving. As US demand falters, Chinese firms are expanding aggressively into emerging markets, especially Southeast Asia and the Middle East, and into higher-margin categories such as EVs, batteries, and technology hardware. Those markets will be crucial in determining whether the October drop proves temporary or the start of a more persistent slowdown.

For now, China’s story feels like one of resilience in the face of pressure. Growth is clearly cooling, but exports remain above $3 trillion year-to-date, and the trade surplus has reached a new record of nearly $965 billion. That external buffer gives Beijing time but not unlimited room to keep domestic demand from sagging further. I wouldn’t bet against Beijing pulling off a revival in domestic consumption, and there are still signs of animal spirits developing in the local investor zeitgeist toward equity markets.

This week…

The week ahead looks quieter on the surface, but the absence of hard data will keep nerves taut. With Washington still shut down, several key US releases, including inflation, won’t appear, leaving investors to steer by market signals and private surveys instead. That loss of visibility alone should keep volatility a touch higher than usual for mid-November.

The real-world impact of the shutdown is also beginning to be felt. Airlines are trimming their schedules, holiday travel plans are fraying, and the damage to confidence may outlast the disruption itself. It’s another sign that a political stalemate can still deliver a material economic sting.

Corporate news will also be thinner, but attention is already turning to Nvidia’s results the following week, the last major test of the AI narrative this earnings season. Expectations are high, sentiment less so. A strong print could revive tech momentum; a stumble would cement the idea that markets have entered a phase of consolidation rather than correction.

In the UK, upcoming GDP and labour data will help confirm the Bank of England’s dovish tilt, while in Europe, updates on trade and industrial output should reinforce the sense of stabilisation rather than recovery.

Expect a bounce if we receive good news on the shutdown front; otherwise, expect volatility to continue.

DOWNLOADS

There are currently no downloads associated with this article.