Market Matters – Waiting For The Catalyst

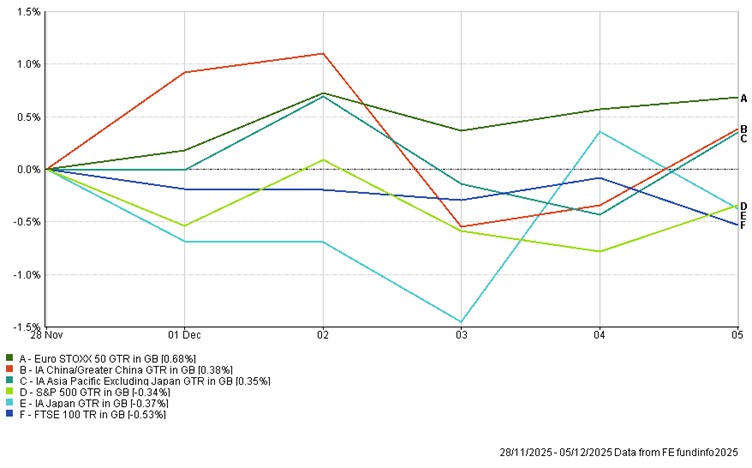

Markets ended the week with a distinctly muted tone. Despite plenty of discussion around year-end rallies and seasonal tailwinds, price action suggests investors remain cautious, selective, and unwilling to chase risk aggressively. There is still no convincing sign of a broad-based end-of-year surge. Performance was mixed across regions, with Asia and Emerging Markets showing relative strength, Europe modestly positive, and the US essentially treading water. Bonds, meanwhile, offered little relief, and UK equities once again lagged.

At the headline level, last week was not short of potential catalysts. A Federal Reserve rate cut this week is now almost entirely priced, inflation data continued to soften at the margin, and US labour market indicators nudged further toward ‘cooling rather than collapsing’. Yet markets struggled to build momentum. That in itself is telling. Investors appear to be in a “wait and see” mode — comfortable enough to hold onto positions, but not yet confident enough to add meaningfully.

Asia ex-Japan and emerging markets were relative bright spots over the week, helped by a softer dollar and some stabilisation in Chinese asset prices. That said, these gains remain fragile. China, in particular, continues to suffer from low confidence, weak domestic demand and a lack of decisive policy follow-through.

Japan stood out briefly mid-week but gave back some gains, highlighting how sensitive the market remains to currency and shifting expectations around Bank of Japan policy normalisation.

Rates, Inflation and the Fed

Inflation remained the central global macro focus. US data was broadly reassuring rather than exciting. While there were no dramatic downside surprises, recent prints continue to support the view that inflation pressures are easing g-r-a-d-u-a-l-l-y rather than re-accelerating. Services inflation remains sticky, but goods disinflation is doing much of the heavy lifting, and wage growth continues to cool incrementally.

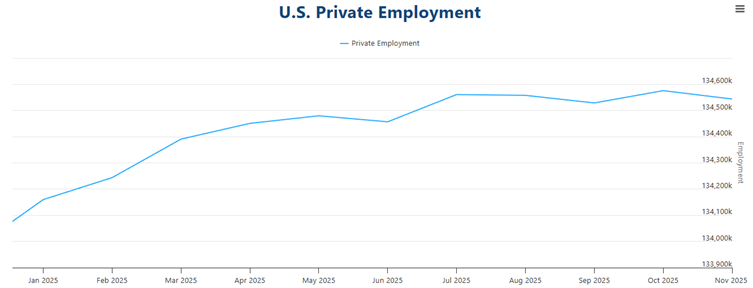

The ADP employment report was perhaps the most important release of the week. Private payroll growth came in slightly softer than expected, reinforcing the idea that the US labour market is losing heat without seizing up. This matters because it gives the Federal Reserve the space it wants: enough softness to justify a rate cut, but not enough stress to suggest policy is already too tight.

Source: ADP Research

Markets now view a December rate cut as close to a done deal. That, however, is precisely the point. With the cut now priced, the focus has shifted from whether the Fed eases next week to what comes after. Investors are increasingly questioning how quickly the easing cycle will unfold in 2026 and whether the Fed will remain cautious amid still-resilient growth.

A brief note on bonds…

Bond markets reflected a similar sense of stasis as global equity markets, as yields struggled to push much lower. With easing now priced, bond investors are wrestling with the same question as equity markets: does policy support translate into meaningful upside from here, or merely cap the downside risks?

In the UK, gilt performance was subdued once again. Despite falling inflation expectations and growing confidence that the Bank of England will follow the Fed into an easing cycle (albeit next year), concerns around fiscal policy, supply, and political uncertainty continue to hang over the market.

In summary – things feel cautious, not capitulative

Sentiment indicators continue to suggest caution rather than outright fear. Institutional positioning remains light relative to historical norms, while retail sentiment has cooled noticeably over recent weeks. That combination helps explain the market’s current behaviour: shallow pullbacks are met with buying interest, but rallies fade quickly as investors take profits rather than press their advantage.

Crucially, this does not look like a market preparing for a sustained risk-off move. Liquidity conditions are improving at the margin, corporate balance sheets remain healthy, and earnings revisions have stabilised. Instead, it feels like a consolidation phase — one in which investors are digesting strong year-to-date performance while waiting for a clearer directional signal.

In short, conditions remain supportive but not convincing. Risk is being carried, not chased — and until liquidity visibly improves, that is unlikely to change.

This week…

With the Fed decision now just days away, this week is pivotal. The cut itself is unlikely to surprise. Instead, markets will focus on guidance, tone, and any hints about the pace of easing in early 2026. Inflation data and labour market updates will continue to matter, but only to the extent they alter expectations about the policy path.

DOWNLOADS

There are currently no downloads associated with this article.