Market Matters – A Measured Start to 2026

Happy New Year to all our readers, and best wishes for a healthy and prosperous 2026.

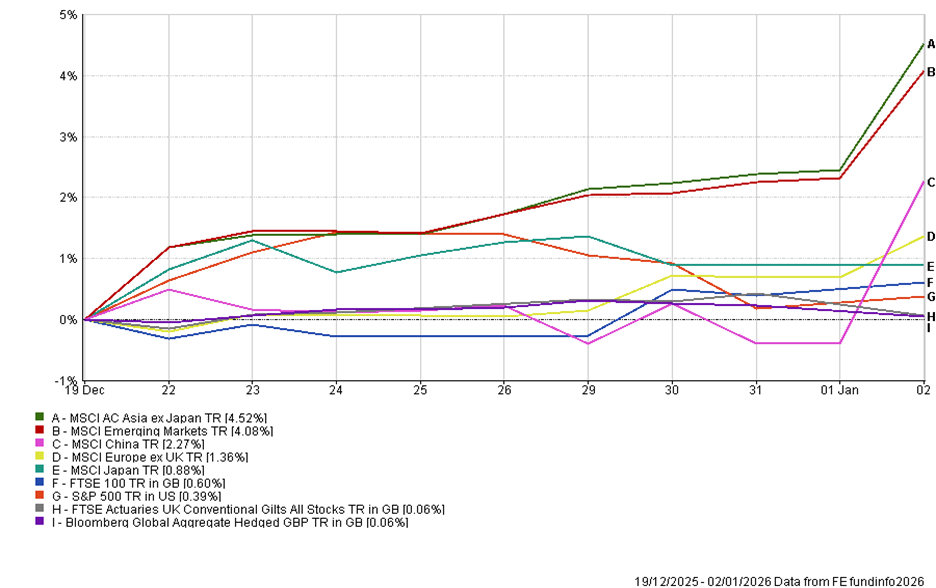

Markets have begun the year in a relatively orderly fashion, although beneath the calm surface, it is clear that investors are once again adjusting to a world in which political and geopolitical shocks can arrive without warning. The final weeks of 2025 and the opening sessions of 2026 have been characterised less by big ‘directional’ moves and more by positioning, narrative digestion and scenario-building, with risk assets broadly resilient but sentiment still cautious.

The UK provided one of the more symbolic moments of the holiday period, with the FTSE 100 briefly crossing the 10,000 level for the first time before giving up those gains. While the milestone itself was fleeting, it underlined how much the narrative around UK assets has shifted. Falling inflation expectations, the prospect of further Bank of England rate cuts and strong performance from banks, energy and defensive sectors have all contributed to renewed interest. That said, thin liquidity and year-end profit-taking meant follow-through was limited, and the index quickly slipped back below the headline level.

The Eurozone has continued to grind higher. European equities ended 2025with the strongest regional performance overall, with banks among the standout performers, rising more than 60% over the year. Momentum carried into the New Year as investors responded to a more constructive macro backdrop. The European Central Bank continues to emphasise domestic demand as the main driver of growth, supported by rising real wages and a resilient labour market. With inflation close to target and policy rates now firmly in neutral territory, lending conditions are improving, a supportive environment for banks and cyclicals alike. Increased defence spending across the region is also becoming a more durable structural theme, particularly as geopolitical risks remain elevated.

Asia has started 2026 with a firmer tone. Chinese and broader Asian equity markets rallied after President Xi delivered a relatively upbeat address, reinforcing Beijing’s commitment to stability, targeted fiscal support and long-term growth objectives. Expectations for a dramatic stimulus package remain low, but that is arguably beside the point. The message was enough to lift sentiment after a subdued end to the year, particularly as valuations remain depressed and positioning light. For Emerging Markets more broadly, falling global inflation, easing financial conditions and continuing weak sentiment continue to provide a constructive backdrop to the very start of the year.

US markets were more mixed. The S&P 500 edged higher over the last few sessions, but the Nasdaq gave back early gains as technology stocks once again proved sensitive to valuation concerns. Weakness in several mega-cap names weighed on sentiment, even as selective strength emerged in semiconductors and AI-linked infrastructure names. Micron’s recent results helped stabilise the narrative around AI capital expenditure, but leadership is becoming increasingly selective. The message from markets remains consistent: AI is still a powerful long-term theme, but it is no longer a one-way trade.

Bond markets were comparatively calm over the holiday period, though yields remain elevated. US Treasury yields ticked higher into year-end, keeping investors alert to the risk that a sustained move higher could pressure equity valuations. In contrast, inflation expectations, particularly in the UK, have continued to decline. The expected average UK inflation rate over the next decade has fallen sharply, giving the Bank of England room to continue easing without undermining credibility. That divergence between nominal yields and inflation expectations remains one of the more interesting cross-asset dynamics as we move into 2026.

Politics and geopolitics have already reasserted themselves as a source of potential volatility. The most striking development over the past few days has been President Trump’s move against Venezuela, culminating in the removal of Nicolás Maduro and the US signalling an intention to ‘run’ the oil-rich nation in partnership with elements of the existing regime.

While the scale of the intervention surprised many, market reaction has been relatively muted so far. That response is telling. Venezuela currently produces less than 1% of the global oil supply, and exports are modest relative to international demand. With oil markets oversupplied and demand seasonally weak, analysts expect only a limited near-term impact on crude prices. Indeed, some have argued that the longer-term implication could even be bearish for oil if sanctions are eventually lifted and foreign investment returns. For now, the episode serves less as an energy shock and more as a reminder that under a Trump presidency, geopolitical flare-ups are never far away.

Crucially, this reinforces a broader point for investors. While geopolitical events may not always move the macro fundamentals, they can and do influence sentiment, volatility and risk premia. From Ukraine to the Middle East to now Latin America, markets are likely to remain sensitive to political headlines even when the underlying economic impact appears limited.

In the US, policy uncertainty remains another key theme. Markets are pricing only a low probability of a Federal Reserve rate cut at the January meeting, reflecting policymakers’ desire for more data. That stance could change quickly. President Trump is expected to name a successor to Jerome Powell in the coming weeks, with Kevin Hassett widely viewed as the frontrunner. Any attempt to remove Powell before the end of his term in May would inject significant uncertainty into markets, particularly for bonds.

US tariffs also remain a major wildcard. The US Supreme Court is due to rule early this year on the legality of tariffs imposed under emergency powers legislation. A ruling in either direction would matter. If struck down, the administration would likely seek alternative mechanisms to replace lost revenues, a more complex process that could reignite deficit concerns and push yields higher.

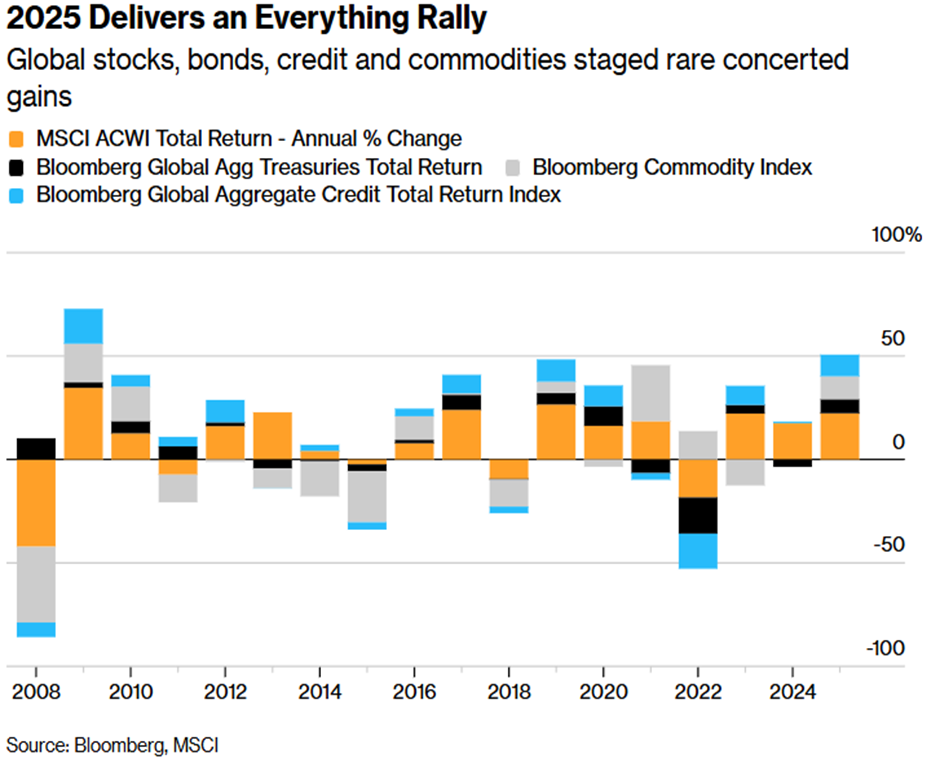

Looking ahead, the immediate focus will shift back to fundamentals. The US fourth-quarter earnings season begins shortly, led by the major banks. Earnings growth, rather than valuation expansion, was the primary driver of equity returns in 2025, particularly after tech multiples peaked and began to compress. That dynamic looks set to continue. While AI remains the dominant strategic theme, investors are increasingly focused on monetisation, margins and capital discipline.

As we enter 2026, let’s hope markets can build on the gains of 2025, an unusual year where just about every asset class made positive returns. I am pretty sure this year will see greater dispersion in returns across asset classes, but for now, the mood seems neither euphoric nor fearful.

Positioning looks broadly set, liquidity is slowly returning, and investors are weighing a familiar mix of opportunity and risk. Inflation is lower, policy is easier, earnings remain resilient, but with Trump in the White House, you never quite know what is coming next.

On that note, let the usual narrative tussle between bulls and bears commence!

As always, we thank our investors for their continued support, and we wish all our readers a happy, healthy and prosperous New Year.

DOWNLOADS

There are currently no downloads associated with this article.