Market Matters – FED cuts into continuing AI wobble

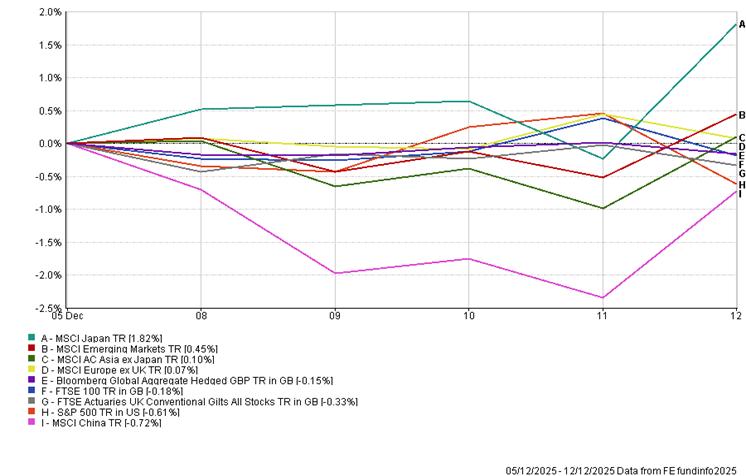

Equity markets spent the week treading water rather than delivering a decisive end-of-year surge. Japan and broader emerging markets crept higher, Europe and the UK eked out small gains, while the US and China slipped back. Bonds were mixed, with global aggregates roughly flat and UK gilts a little weaker. Under the surface, the tone felt far more volatile than the headline moves suggest, as another bout of AI angst and a sharp selloff in parts of the tech complex overshadowed what was, on paper, a supportive week for policy and growth expectations.

The US: remains the pivotal story around which the market pivots. As widely expected, the Federal Reserve cut rates by a further 25 basis points, taking the fed funds range to 3.5 to 3.75% and bringing total easing so far this cycle to 175 basis points. The messaging, though, was classic ‘hawkish cut’. Jerome Powell repeatedly described policy as now sitting in a range of plausible estimates of neutral. He stressed that the committee is well-positioned to judge future moves based on incoming data. The latest dot plot has the median official pencilling in only a modest further decline in rates, with the funds rate drifting to around 3.4% next year and 3.1% in 2027. Three members already think the policy is below neutral, and seven do not see any further cuts in 2026.

The economic projections were not exactly recessionary. The Fed nudged up its GDP forecasts, acknowledging that productivity has been doing more of the heavy lifting than previously assumed and still expects growth close to trend over the next couple of years. Inflation is forecast to ease from around 3% on the Fed’s preferred PCE measure this year to 2.5% next year and just above target thereafter, helped by the inflation pulse from Trump’s tariffs fading. Unemployment is projected to rise only gently to the mid-4s before edging lower again. Powell sounded more worried about the labour market weakening than about inflation sticking at 3%, which is not the usual tone for an inflation-obsessed central banker…

Markets labelled it a hawkish cut because the Fed is clearly in no rush to drive rates deep into stimulative territory. Yet from an investor’s perspective, the direction of travel and narrative matter more than the precise number of cuts. Policy is easier than it was, the yield curve continues to steepen, and ten-year Treasury yields sit just above 4% rather than flirting with 5. It is no surprise that financials responded well. What unsettled investors instead was the ongoing shake-out in the AI and broader tech space, amplified by sharp moves in bitcoin and continued debate about whether AI capex is a bubble or a rational response to a genuine productivity boom. Alphabet’s latest model news, questions about GPU life cycles and a more discriminating market reaction across the chip and cloud complex all contributed to another choppy week for the leadership names of the last two years.

Our view is that this is a healthy, if uncomfortable, phase. The AI trade is moving from story to sorting, as investors try to distinguish durable earnings power from hype. That process can easily knock a few percentage points off headline indices in the short term. Still, it does not overturn the broader picture of easing policy, solid US growth and rising earnings expectations into next year. Once the dust settles, dip buyers are likely to reappear in sufficient numbers to drive the S&P 500 to new highs, but the Mag 7 might not be the leaders next year, as we are beginning to see a sustainable rotation into the ‘493’ and small- and mid-cap.

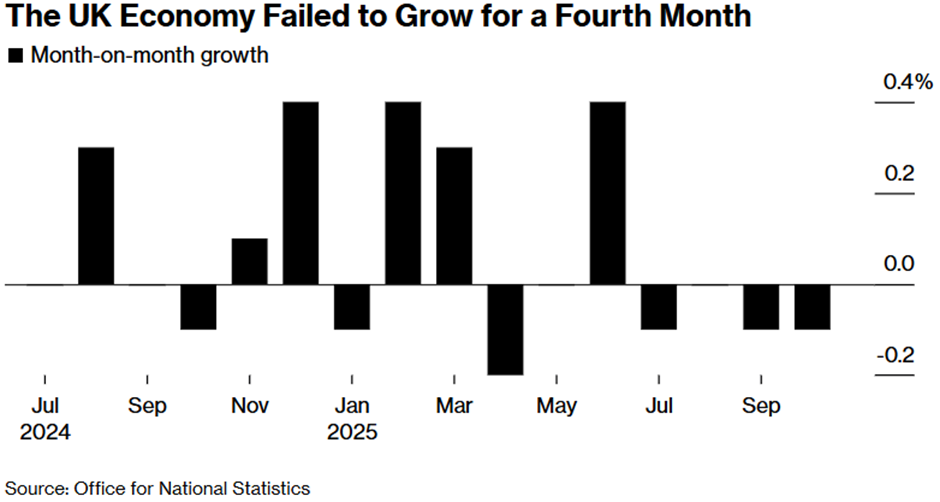

UK: On this side of the Atlantic, the UK managed the neat trick of delivering both softer inflation expectations and weaker growth. October GDP fell 0.1% repeating September’s decline and leaving the economy with no net growth since June. Services output contracted again, construction activity slipped, and only a modest rebound in industrial production prevented a worse print. Forward-looking indicators from retailers are equally downbeat. Black Friday discounts came earlier and sharper than usual, but total retail sales growth in November was barely above 1% year on year, with non-food spending flat and households clearly trading down or hunting promotions.

Pre-budget nerves, talk of tax rises, and the persistent squeeze on real incomes have all weighed on confidence. Surveys suggest that around one in five households now describe their finances as strained, and card data show that non-essential spending is in outright decline. This matters because the Chancellor’s fiscal arithmetic relies on consumers loosening their purse strings next year. If they do not, the much-discussed hole in public finances will quickly be back on the agenda.

The silver lining is that both realised and expected inflation are drifting lower. The Bank of England’s latest survey shows households expecting prices to rise by around 3.5% over the next year, a touch below the previous reading, and by less than 4% over five years. With GDP stalling, unemployment rising, and pipeline price pressures easing, markets are almost entirely priced for another quarter-point cut from the Bank next week. Sterling has softened and gilt yields have come in, but UK equities have taken the gloom in their stride, helped by already low valuations and the prospect of easier policy in 2026.

China: offered a different flavour of cautious support. The Central Economic Work Conference set the broad policy tone for 2026, with the message of measured stimulus rather than another big bang. Officials pledged to keep monetary policy supportive, using interest rate and reserve requirement cuts ‘flexibly and efficiently’, and to maintain a necessary budget deficit, which most observers read as similar to this year’s roughly 4% of GDP. The focus is shifting from firefighting tariffs towards sustaining growth with a manufacturing-led strategy, while acknowledging mounting domestic headwinds.

Three areas stand out. First, investment has slumped sharply in recent months, especially in traditional infrastructure and property. Beijing now promises more central government spending on investment projects and a clearer plan to deal with local government financing vehicles, which should help contain the worst of the credit stress. Second, the property market gets explicit attention, with a commitment to control new supply and encourage the purchase of unsold housing stock for conversion into affordable homes. That helped property shares to bounce, though from depressed levels. Third, policymakers are signalling a desire to keep the renminbi broadly stable, resisting calls for a significant appreciation even as the trade surplus stays very large.

For investors, this means China is unlikely to deliver a massive stimulus surprise, but it is equally unlikely to slam on the brakes. Growth should remain respectable, supported by exports and targeted public investment, while the housing correction is managed rather than allowed to spiral out of control. That is supportive for Asia and Emerging Market earnings next year, even if it does not immediately reverse the recent underperformance of Chinese equities.

Looking ahead: The AI shake-down and year-end positioning still dominate the near-term picture, but the medium-term story is quietly improving. The Fed is cutting, even if reluctantly. The Bank of England looks set to re-enter the easing cycle. Europe is already there. China is signalling steady, if modest, stimulus to defend growth. Global earnings revisions remain positive, and productivity trends, especially in the US, look more encouraging than policymakers are willing to admit. Next week brings a dense run of macro releases that could reinforce this trajectory: US CPI, PPI, retail sales and industrial production; UK labour data and CPI ahead of the BoE; Eurozone PMIs; and a full slate of Chinese activity indicators. It’s one of the last big macro weeks of the year.

It will not be a straight line. AI winners and losers will continue to be sorted, politics will generate noise, and there will be weeks when bitcoin or a single mega-cap seems to dictate index moves. But if we clear the current bout of AI nerves, the foundations for equities into 2026 still look supportive: easier policy, steady growth and a wider opportunity set beyond the handful of giants that led this cycle. We are still climbing a wall of worry, exactly what a bull market is supposed to do.

DOWNLOADS

There are currently no downloads associated with this article.