Market Matters – Q4’s Early Momentum Fades as Markets Hit an Air Pocket

Market Overview

Markets have stumbled into late November, giving back much of their early-Q4 progress and slipping into a phase of broad but uneven consolidation. Japan remains the clear standout — supported by solid earnings, a softer yen, and, more recently, a wave of government stimulus that has buoyed sentiment. Europe and Asia, excluding Japan, have managed to hold on to modest gains, while the UK and global bonds have been subdued but at least offered some ballast for diversified portfolios.

The US, however, has slipped into negative territory for the month as volatility in megacaps spills over into global risk assets. China remains the weakest major market, extending its decline and now down nearly 9% since early October amid ongoing growth concerns. Taken together, Q4 has so far delivered a patchy landscape: a strong Japan at one end, a struggling China at the other, and a collection of mildly positive but cagey regions in between.

US volatility spooking all markets – but still no fundamental weakness

The US remains the epicentre of recent market turbulence. For the past fortnight, it has traded in a state of uneasy drift, caught between outstanding tech earnings and an increasingly noisy macro backdrop. Nvidia’s results reaffirmed the scale and durability of the AI investment cycle, but they didn’t settle the debate around capital intensity, monetisation timelines, and the near-term impact on margins. Investors are still weighing whether record data-centre spending delivers earnings quickly or whether the payoff will be slower and more cloud-driven than the market’s more exuberant narratives imply.

At the same time, the labour-market picture has become more challenging to read. Employment growth remains comfortably above breakeven, yet hours worked have stalled, continuing claims have risen, and younger graduates are finding it harder to secure jobs. This is a cooling labour market, not a collapsing one, but it has added to the sense of policy confusion. Stronger payrolls argue against a December rate cut; rising unemployment argues in favour of one. Fed officials are now openly contradicting each other, and with no October Non-Farm Payrolls missing due to the shutdown and the November print due after the next Fed meeting in December, investors are trading without the usual macro anchors.

It is fair to say that some of the equity weakness reflects liquidity stress, rather than any deterioration in fundamentals. Segments with high embedded leverage, crypto, momentum ETFs, and high-beta tech have experienced the sharpest swings, as thin November liquidity amplifies every move. It is uncomfortable, but entirely typical of late-year trading and probably not indicative of underlying economic fragility. Bond yields remain stable, credit spreads are well behaved, and corporate earnings continue to trend higher.

The bigger picture

Take a step back from the day-to-day volatility, and the broader picture looks considerably more encouraging. Yes, markets have been rattled by talk of an AI bubble, record AI capex, and a couple of high-profile investors trimming their Nvidia positions. Yes, the slide in bitcoin has muddied sentiment, given its tight correlation with high-beta tech. And yes, the Fed’s mixed messaging has produced genuine confusion at a time when investors crave clarity. But, and I say this with mild trepidation, fully aware I may yet have to eat these words, none of these issues undermines the foundations of the bull market.

First, AI bubble fears are largely sentiment-led. The spending boom is real, but so is the productivity uplift. Hyperscalers monetise AI not simply through ‘AI products’, but through the surge in compute, storage, model training, inference, and cloud throughput, which is the real economic engine. The accounting debate may continue, but the earnings trajectory remains positive and the structural demand story intact.

Second, bitcoin’s plunge is a liquidity signal, not an economic signal. It matters as an edge case because liquidity always matters, but it tells us nothing about the underlying health of the US economy or the direction of corporate earnings. These episodes tend to burn out once forced sellers finish their work.

Third, the labour market is softening, not breaking. The rise in unemployment among younger workers is notable, but not systemic. Hours worked have plateaued, yet GDP has been running close to 4%, implying strong underlying productivity gains, which is precisely what equity markets ultimately reward. And the Fed’s internal disagreements are, paradoxically, a sign of progress: inflation is now low enough that reasonable policymakers can disagree on the pace of cuts. That is not how monetary policy looks in a late-cycle or recessionary phase.

Finally, earnings are still rising not just in the Mag-7, but across the “insignificant 493”. This remains an earnings-led market with a positive revision cycle, the exact opposite of a bear-market setup. The pullback of the past two weeks has been sharp, but sentiment has swung sharply with it: fear gauges have reset, positioning has lightened, and several timing indicators now suggest that conditions are forming for a rebound.

The optimist in me would argue that with productivity improving and corporate earnings still trending higher, momentum should carry through into 2026. This pullback looks far more like the usual messy, uncomfortable reset that strong markets deliver after a long run, rather than the end of the story. And the best evidence for that sits inside the earnings season we’ve just had. Q3 revenue growth for the S&P 500 has climbed to 8.4%, the strongest in three years and almost double what analysts expected in June. All 11 sectors are now showing positive revenue growth, and 3 are delivering double-digit gains.

What’s striking is how broad the improvement has been. Healthcare and Financials each contributed about 20% of the upgrade to index revenues since September, with consistent beats from CVS, Cigna, Cardinal Health, JPMorgan, Morgan Stanley, and Goldman Sachs. Consumer Discretionary has also been a positive surprise, led by Ford, GM, Amazon, and Tesla. And, of course, the big AI-aligned names like Alphabet, Microsoft, Walmart and Nvidia have added further upside.

Rising revenues plus firming margins point to something markets often miss in the noise: productivity is already showing up in the numbers. You don’t get near-4% GDP growth with flat hours worked unless efficiency is improving and early AI adoption is clearly part of that story. Even if revenue growth moderates from here, the underlying earnings backdrop remains supportive. That’s why, despite the volatility, the broader picture still argues for a bull market that is very much intact, pausing, not collapsing.

UK – Sliding into budget week with a fragile backdrop

If the global picture is one of uneven consolidation, the UK sits at the softer end of that spectrum. As we pivot from the US to our domestic backdrop, the contrast is striking. Where the US continues to deliver robust data and rising earnings, the UK heads into next week’s highly anticipated budget with a combination of weakening growth, political tension and a fiscal landscape that looks increasingly stretched.

The latest PMI numbers captured this loss of momentum. Private-sector output has sharply declined from 52.2 to 50.5, just above the contractionary threshold. This decline is due primarily to the services sector, which is typically a primary driver of growth, reporting its first decrease in new orders since July. Retail sales have slipped, consumer confidence has plunged, and unemployment has edged up to 5%. Wage growth is easing. Employment is falling as firms opt not to replace leavers and, in some cases, substitute technology for labour. Across the private sector, the sense is one of hesitation: paused orders, delayed investment decisions and a rising fear of tax hikes ahead of the budget.

Layered on top is a political environment that has become unexpectedly volatile. A backbench revolt and rumours of a leadership plot have forced the Chancellor into rapid U-turns just days before the fiscal event. Her original plan, a broad-based income-tax rise to plug a £20–30 billion hole, has proved politically impossible, and she now must rely on a patchwork of smaller, more distortionary measures. Markets tend to dislike that approach, and the 2012 ‘omnishambles budget’ looms unhelpfully in the retina of memory!

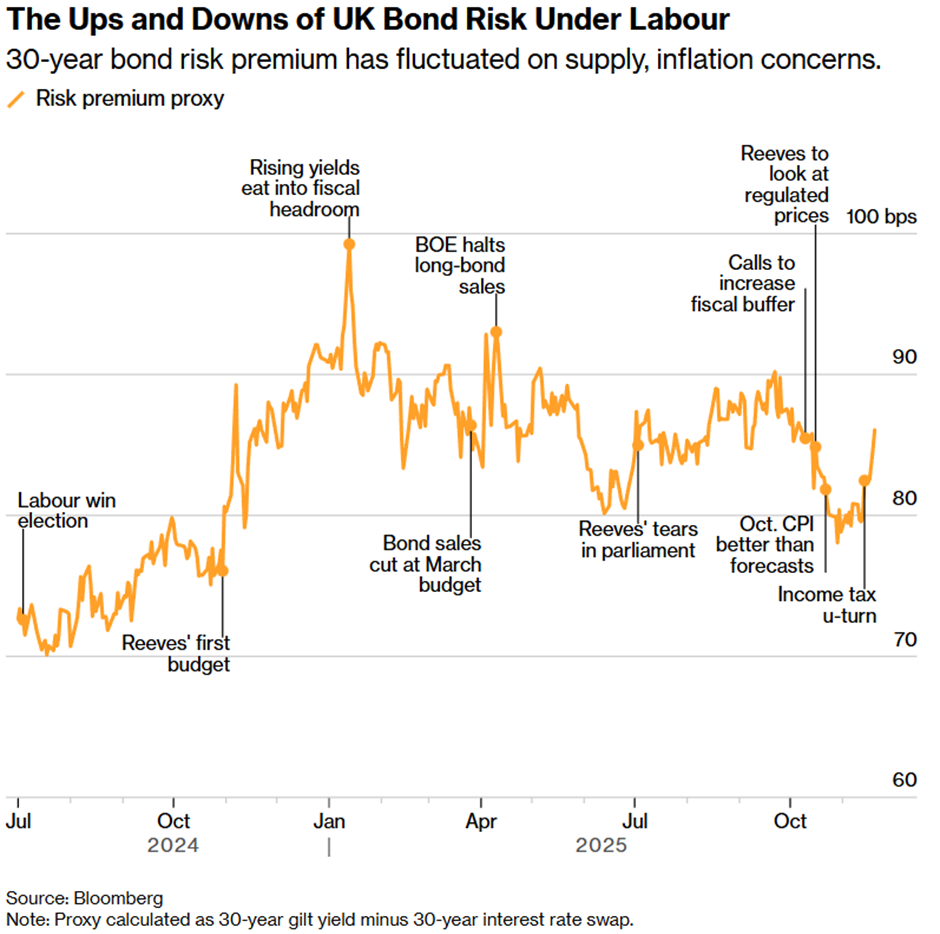

The fiscal arithmetic is undeniably complex. Borrowing costs are higher, the OBR is revising down productivity assumptions, welfare cuts have been watered down, and the gap between fiscal rules and fiscal reality has widened. Reeves must now reconcile bond-market discipline, manifesto pledges, and internal party pressures – a ‘trilemma’ with no clean solution. It is no surprise that gilt volatility has picked up and the UK’s sovereign risk premium has widened versus the US, Germany and Japan.

And yet, the outlook is not uniformly negative. The UK economy may be fragile, but the UK stock market is structurally better insulated than the headlines suggest. The FTSE remains dominated by global-facing multinationals in energy, mining, financials, pharmaceuticals and consumer staples, businesses whose earnings depend far more on global demand than on UK domestic conditions. If sterling softens into the budget, as often happens when fiscal uncertainty rises, many of these companies actually benefitvia translation effects. A weaker pound may be bad for households, but it can be a tailwind for UK-listed earnings.

Add in the FTSE’s defensive tilt, its heavy weighting in cash-generative sectors, and still-depressed valuations, and the UK equity story is more nuanced and potentially more resilient than the macro data imply. Even in the face of weaker growth and political tension, the market’s global mix, low expectations and currency dynamics offer natural buffers that the domestic economy itself lacks, sufficient to drive the FTSE 100 to outperform the S&P 500 in GBP terms this year.

So in short, the UK enters budget week on a fragile footing, both economically and politically. But for us, the story is more balanced. Fiscal risks are rising, gilts may remain jumpy, and the growth outlook is uninspiring. Yet, the structure of the UK market still provides defensive characteristics and scope for relative outperformance if sterling weakens. It is a cloudy macro picture, but not without bright spots for well-diversified portfolios.

Europe – Quietly re-accelerating beneath the surface

If the UK is heading into its budget week on uneasy footing, Europe is quietly moving in the opposite direction. The latest euro-area PMI data surprised positively again, with the composite reading at 52.4 barely changed from October’s 52.5 and still comfortably in expansion territory. It’s now been two consecutive months of broad-based growth, driven overwhelmingly by the services sector, which just logged its best month in a year and a half.

Germany remains a key driver, even if the pace cooled slightly (52.1). France, despite its tensions, beat expectations and edged back toward the 50 line. Manufacturing remains soft, but its drag is being more than offset by a healthier services backdrop and resilient domestic demand. For the fourth quarter, the eurozone now looks set to grow faster than in Q3, which is not spectacular, but solid and improving.

This stability matters because Europe has spent much of the year absorbing uncertainty from the US trade agenda and wrestling with its own budget disputes. Yet the underlying story has turned more positive:inflation is back near target, rates have already been cut to 2%, and a wave of public-investment spending- infrastructure, energy transition, defence – is gradually feeding into activity. Policymakers now have breathing room, and the ECB looks comfortable ‘sitting tight’ for the rest of the year.

There are still disparities across the bloc, but the overall shape is constructive: moderate growth, anchored inflation, an improving services sector and a supportive policy stance. Against a jittery global backdrop, Europe is proving steadier than many expected and may even offer a relative haven into year-end.

Japan: Stimulus strength meets geopolitical stress

Japan continues to be the relative bright spot in an otherwise choppy Q4. Solid earnings momentum, a softer yen and renewed investor inflows have kept the market ahead of global peers — and last week delivered another tailwind in the form of a ¥21.3 trillion ($135bn) stimulus package. Prime Minister Takaichi has wasted no time, approving the largest set of fiscal measures since the pandemic, aimed at easing price pressures, supporting consumption and accelerating investment in defence, infrastructure and key strategic capabilities. It meaningfully strengthens Japan’s near-term growth backdrop and should provide support well into early 2026.

However, the improving macro picture now sits uncomfortably alongside a sharp deterioration in relations with China. Beijing accused Takaichi of altering Japan’s long-held stance on a hypothetical Taiwan crisis, even warning of “self-defence” measures should Japan “dare intervene militarily” — an escalation that prompted Tokyo to respond forcefully, dismissing the accusation as “entirely baseless.” The episode has already spilt into diplomacy, with cancelled ministerial meetings and a series of public statements on both sides that have further hardened the tone.

The risk here is not immediate conflict but a creeping deterioration in the economic relationship. China is Japan’s largest trading partner, a major source of tourists, and a crucial supplier of rare earths to Japan’s manufacturing base. There are already anecdotal signs of Chinese tourists cancelling trips and concerns over future trade frictions. Markets have largely shrugged this off for now, but the temperature has clearly risen and bears monitoring.

For the moment, though, Japan retains one of the cleanest macro runways among major markets. Earnings are holding up, the weaker currency continues to support exporters, policy remains accommodative, and the new fiscal package gives the domestic economy a genuine lift. The geopolitical shadow is real, but it does not yet overshadow the broader constructive case.

China: Stabilisation signs, but still no clarity

If Japan looks like the bright spot, China remains the question mark. Recent data has been mixed rather than outright negative, but the market narrative continues to swing between fragile stabilisation and lingering structural drag.

Last week provided both.

On the positive side, the latest activity indicators showed modest resilience. Industrial production has held up better than feared, exports have stabilised (helped in part by tariff-routing through lower-duty jurisdictions), and earlier easing measures — particularly around credit provision, state-led investment and property support — are finally showing tentative signs of traction. Several high-frequency indicators suggest that the worst of the contraction phase is behind us, even if the recovery is shallow. Markets took some encouragement from this, with investors increasingly expecting incremental but ongoing policy support through year-end.

However, these green shoots coexist with more persistent headwinds. Manufacturing PMIs are still oscillating around contraction levels, domestic demand remains weak, and the property sector is far from resolved. Confidence among households and private firms is yet to rebuild meaningfully. The geopolitical backdrop also remains tight, with tariffs, US–China technology frictions and regional tensions keeping a cap on risk appetite. None of this has changed in the past week.

Equity performance reflects this dual reality. China has been one of the worst-performing major markets this quarter, down nearly 9% since early October, and foreign inflows remain sporadic at best. While some tactical rallies are likely, especially if US liquidity improves or if Beijing adds further stimulus, a durable re-rating still requires clearer evidence of domestic demand recovery.

Nevertheless, despite the Q4 sell-off, China remains the standout region for equity performance this year…

Still, there is a constructive thread here. China is not contracting; it is grinding higher. External demand is stabilising, stimulus is incremental but persistent, and inventories are lean across several sectors, including semiconductors and components linked to global AI and data-centre supply chains. For global investors such as ourselves, China remains a great source of diversified returns, and there remains potential upside surprise if policy traction improves more visibly into 2026.

This week…

With the UK Budget approaching, markets are set for another unsettled week. Most of the fiscal debate is already in the price; what matters now is how gilts, sterling and domestic risk assets react, and whether investors see the package as credible. That alone is enough to keep near-term volatility elevated.

Away from the UK, the global picture is still driven more by liquidity and sentiment than fresh macro data. Friday’s rebound in US equities was encouraging, but it wasn’t decisive. We’ll need to see whether buyers follow through or whether it proves to be just another end-of-the-week positioning squeeze. The weekend stabilisation in Bitcoin after a month of heavy deleveraging hints that some of the liquidity pressure may be easing, but it’s not a reliable directional signal in itself.

Taken together, the setup remains finely balanced. Policy noise is high, liquidity is thin, and markets are jumpy… but positioning has already lightened, and sentiment is now much more cautious.

Conditions are present for either benign stabilisation or another bout of volatility; it strikes us as an ‘all or nothing’ week.