Market Matters – Quiet Week but lots bubbling under the surface

Market Overview

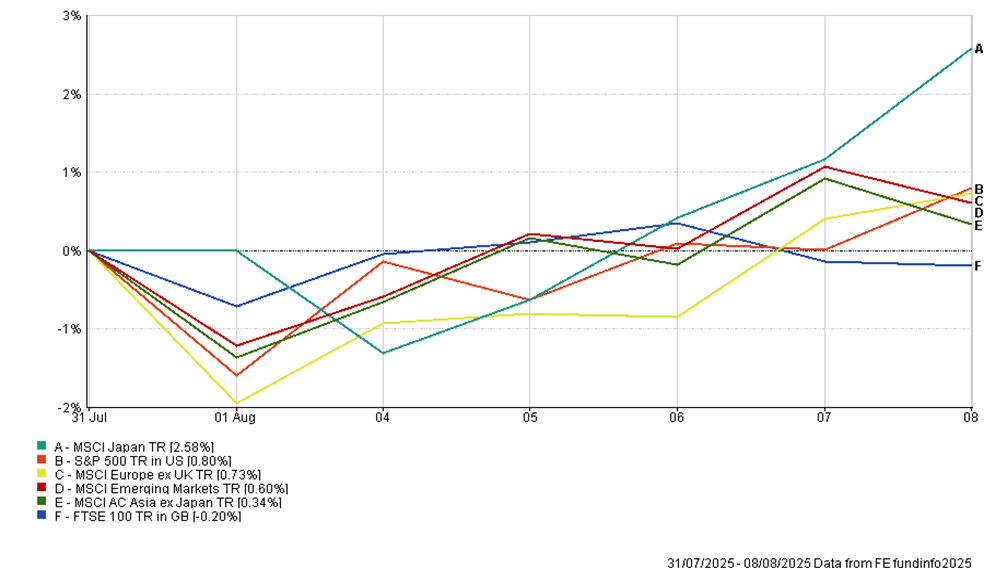

After last Friday’s wobble, markets regained their footing this week. Global equities are back within sight of record highs, helped by a combination of lighter economic data flow, steady earnings, and a dose of geopolitical optimism. Reports that President Trump and President Putin will meet in Alaska later this month to discuss a possible resolution to the Ukraine war have lifted European markets in particular, where sentiment has been weighed down by the conflict’s drag on growth and energy costs. While Ukrainian and European leaders have stressed that any deal must involve Kyiv and protect its sovereignty, the prospect of even tentative peace talks was enough to give risk assets a tailwind.

In Washington, President Trump sacked Bureau of Labour Statistics chief Erika McEntarfer just hours after the weak July jobs report, leaving her deputy in temporary charge and raising fresh questions over the agency’s independence. Days later, he nominated Stephen Miran, a loyal economic adviser and outspoken advocate of deep rate cuts, to the Federal Reserve Board. The twin moves fuel concerns over political interference in data and monetary policy, even as markets remain more focused on the near-term boost from easing recession fears than on the longer-term risks to institutional credibility.

Last week’s tariff announcements dealt heavy blows to some and handed lifelines to others. India was hit with a 50% levy, largely over its Russian oil trade, threatening tens of billions in electronics exports. Switzerland faced a 39% tariff targeting its gold-refining industry, sparking political outrage and talk of shifting production abroad. In the tech sector, the US imposed a 100% duty on imported semiconductors but offered exemptions to firms committing to build in America, a move that lifted shares of companies like Apple and US-based chipmakers, while leaving foreign-only producers facing higher costs and potential market share losses.

UK – BOE cuts!

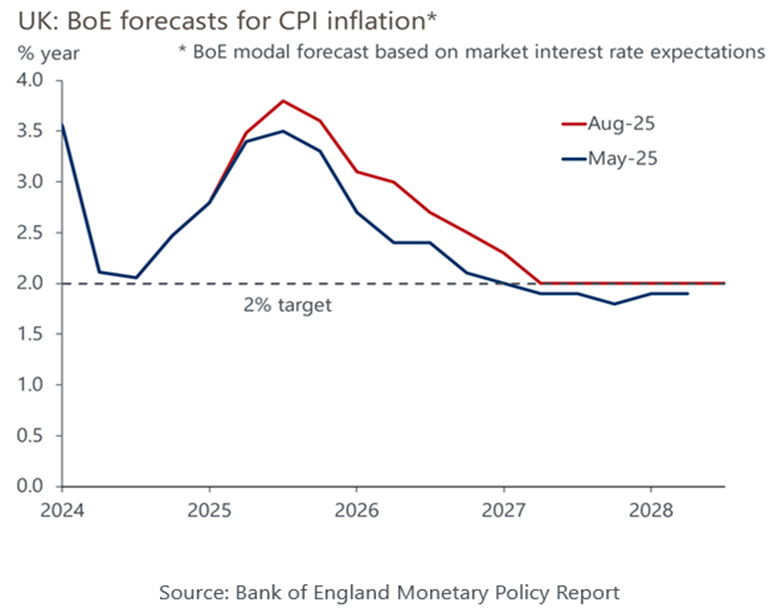

Against a backdrop of shifting global trade winds, attention in the UK turned to monetary policy. The main economic event closer to home was the Bank of England’s closely watched August meeting, which delivered a 25bps rate cut to 4% but only after a knife-edge vote. The initial split saw one member push for a 50bps cut, four for a 25bps cut, and four for no change. Only after a second round of voting, with the 50bps option removed, did a narrow 5-4 majority emerge in favour of easing. The hawkish camp, including Greene, Lombardelli, Pill and Mann, argued that recent upside surprises in food and fuel prices risked embedding higher inflation expectations, despite evidence that wage growth is cooling and labour market slack is building. The doves pointed to weak activity, falling pay settlements, and the risk of recession as justification for loosening policy.

The Bank also published its updated forecasts, now projecting inflation to average 0.4 percentage points higher over the next 18 months than in May, peaking at around 4% later this year before returning to its target. While this path still supports market expectations for around two more quarter-point cuts over the next year, the tone of the minutes was less dovish than in June, and the November cut we expect now looks far from certain. The MPC’s annual review of quantitative tightening concluded that the £100bn-per-year programme has so far had little impact on market liquidity or gilt yields — but hinted at a likely slowdown to £75–80bn, with a shift toward selling more short- and medium-dated gilts. With Governor Bailey emerging as the swing vote and the inflation data likely to be noisy in the months ahead, the next move will hinge on whether price pressures in those highly visible food and fuel categories start to fade.

For markets, the message was one of caution rather than celebration. Gilts rallied modestly on the cut, but the tight vote and higher inflation profile tempered expectations for a rapid easing cycle, keeping short-end yields supported. Sterling held its ground, reflecting both the Bank’s reluctance to pre-commit and the still-elevated services inflation backdrop. UK equities, particularly domestic cyclicals, took the rate cut as a welcome, if limited, boost, but investors are mindful that the next move is far from a done deal. With fiscal tightening on the horizon and food and fuel costs still a political and economic headache, positioning is likely to stay tactical until there’s clearer evidence that inflation is back under control.

India & China

Moving focus from our small island economy, where a quarter-point rate cut is the big drama of the week, to the sprawling, swaggering markets vying to be the future powerhouses of the global economy. While the UK debates the fine print of CPI and gilt sales, India and China are grappling with tariffs, trillion-dollar valuation gaps, and the race to dominate the next era of global growth.

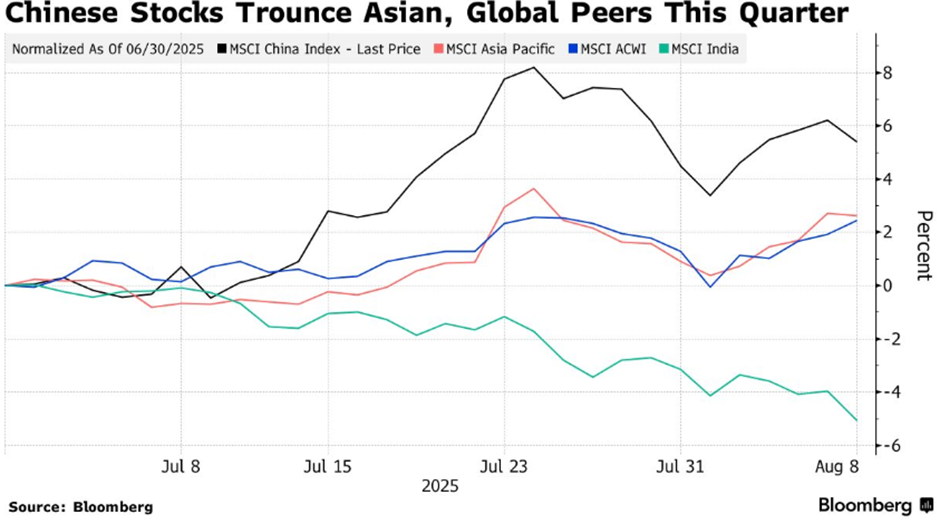

Trump’s latest tariff salvo is widening the gulf between the two. India’s MSCI index has lagged China’s by 10 percentage points this quarter, and the $6.3 trillion valuation gap between their equity markets is now the widest since March. The 50% levy on Indian exports, half of it tied to New Delhi’s Russian oil purchases, has rattled investors, particularly given Beijing’s larger Russian import volumes and exemption from similar penalties as it awaits an extension of its trade truce with Washington.

The selective targeting has amplified concerns already hanging over India: stretched valuations, moderating earnings growth, and the possibility that tariffs will blunt its ambitions to be the world’s next manufacturing hub. Foreign investors withdrew $3 billion from Indian stocks in July, the sharpest monthly outflow since February, while domestic institutions have had to step in with heavy buying to support prices. By contrast, Chinese equities have drawn renewed interest. Policy easing, the government’s ‘anti-involution’ push, and a string of AI breakthroughs have added momentum, all at far more modest valuations. The MSCI China index trades at less than 12x forward earnings versus over 21x for India.

Strategists now see scope for China to outperform in the coming quarters, particularly in sectors such as clean energy, biotech, and AI, while India’s near-term prospects appear more defensive. That said, the long-term Indian growth story remains intact, with demographics, infrastructure development, and a deepening domestic investor base providing it with staying power. However, until the tariff overhang is lifted, India is likely to play second fiddle within regional allocations, while China, the former ‘uninvestable’ market, enjoys an unlikely return to the spotlight.

US – Earnings Still Strong

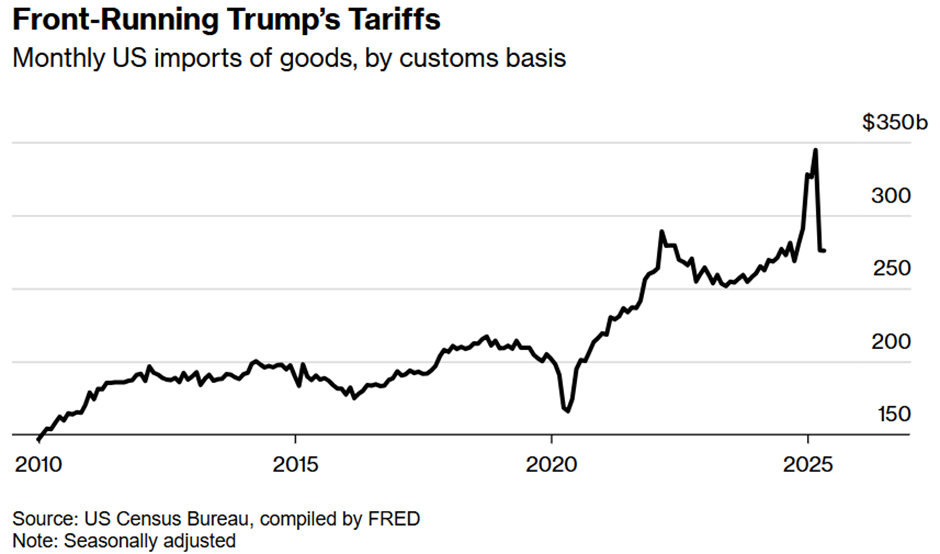

And finally, as US Q2 earnings wrap up, companies continue to outpace analyst expectations, helped, in part, by forecasts that were arguably set conservatively. With earnings growth tracking near 12% and nearly 80% of firms beating EPS estimates, the market has found fresh breathing room, bolstered further by a wave of positive forward guidance from tech and health‑care players reinforcing optimism. That said, the full cost impact of last week’s tariff surge is just beginning to surface. Most firms report resilience in margins for now, but names like Yum! Brands have already flagged pressure, and Caterpillar’s warning of up to $1.5 billion in tariff-related costs is a reminder that the margin squeeze could intensify down the road. So while earnings continue to support the rally, the outlook remains finely balanced between easing surprises and rising trade risks.

For now, corporate America is still delivering results that look largely untouched by the tariff shockwave. Earnings are beating estimates, forward guidance is holding up, and for most sectors, margins remain intact. Much of this resilience rests on forward-bought inventories, cost-absorbing balance sheets, and the fact that companies are reluctant to antagonise customers with visible price hikes while demand is still holding up. But that can’t last forever.

As stockpiles run down and the rules of the tariff game settle into something more permanent, firms will face a choice: eat into profits or pass the bill on to consumers. History suggests they’ll delay as long as possible. Still, the economics will eventually assert themselves, whether in the form of higher prices, reduced quality, fewer options, or all of the above. We’ve seen this movie before; the adjustment phase can be slow and uneven, but once it arrives, it tends to be felt quickly in reported margins.

For markets trading on stretched valuations, the timing of that shift will matter enormously. Rich multiples can be sustained when earnings are rising, but they’re far less forgiving when growth flattens or margins contract. Ideally, by the time tariff pressures start biting, the Fed will have begun cutting rates, cushioning the blow with cheaper capital. In contrast, the fiscal lift from OBBBA and the incremental productivity gains from AI adoption start to feed through into corporate bottom lines. That combination could offset some of the drag and extend the cycle.

If those offsets aren’t in place, however, the market will lose one of its key props. Earnings have been the ballast in this rally, allowing investors to look through political noise and macro cross-currents. Remove that support without a compensating policy or productivity boost, and the re-rating risk becomes far greater, especially for the segments of the market where expectations and valuations have already drifted into the stratosphere.

This Week…

A big week looms large, and with August’s historically thin trading volumes, the risk is that market moves are amplified well beyond what the fundamentals alone might warrant. It’s a month that has not been kind to equities in the past, and the coming days will test whether this year can buck the trend. In the US, Tuesday’s CPI print is the headline act as a potential inflexion point for the Fed’s rate path and the first real chance to see if tariff pressures are beginning to bleed into consumer prices. It kicks off a run of heavyweight data, from PPI to retail sales, industrial production and the University of Michigan’s sentiment survey, each adding its twist to the growth-versus-inflation narrative.

Layered on top is a geopolitical wildcard: Washington’s decision on whether to extend its trade truce with China. A collapse in talks could quickly sour sentiment, reignite supply chain worries, and undo much of the recent calm. Asia will also be in sharp focus as China releases July retail sales, industrial production and trade numbers, data that will help determine whether policy easing and AI-driven optimism are translating into broader economic momentum.

Europe and the UK step into the frame with Q2 GDP and German CPI, providing investors with a clearer view of how post-tariff frictions are being felt. On the micro side, earnings season isn’t over yet, with Deere, Cisco Systems, and Applied Materials set to report, offering fresh insight into capex trends, demand conditions, and the resilience of margins in a shifting trade environment.

In a month that has a habit of springing nasty surprises, investors will be hoping that the combination of data, policy decisions and earnings updates delivers more reassurance than volatility. We are bracing for both.

DOWNLOADS

There are currently no downloads associated with this article.